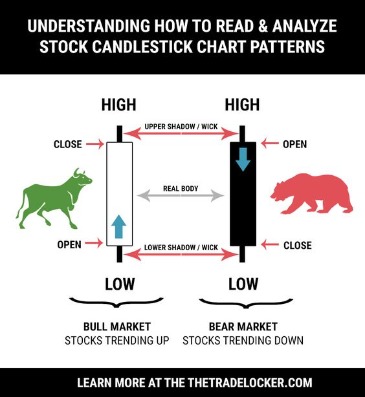

Traders should stay updated with financial news and analysis to make informed trading decisions. Generally, a morning star pattern is very reliable, especially if it is incorporated with other technical indicators and further analysis of the asset. The chart above has been rendered in black and white, but red and green have become more common visualizations for candlesticks.

AUD/JPY Price Analysis: Defies downtrends as a morning star pattern, suggests upside expected – FXStreet

AUD/JPY Price Analysis: Defies downtrends as a morning star pattern, suggests upside expected.

Posted: Thu, 13 Jul 2023 07:00:00 GMT [source]

Another technique that some traders utilize for entering into a long position following the Morning Star pattern is to wait for a minor retracement of the third candle. The logic here is that the market should subside a bit following the Morning Star formation, providing a better entry for the long position. The Morning Star pattern is a candlestick formation that is often seen within the price action.

The difference between evening star and morning star candlestick

From beginners to experts, all traders need to know a wide range of technical terms. Below you will find the price chart of the Euro to Yen currency pair shown on the daily chart. The Stochastics indicator is a popular oscillator that provides oversold and overbought readings based on a default look back period of 14 days. The Stochastic oscillator has two primary lines, the faster percent K line which is more sensitive, and the slower percent D line which is less sensitive.

Finally, the white candlestick needs to close above the point where the black candle is exactly halfway through its body. The Morning Star pattern can be observed in the EUR/GBP chart below, where there is an established downtrend leading up to the formation of the reversal pattern. Deepen your knowledge https://g-markets.net/ of technical analysis indicators and hone your skills as a trader. Now with these conditions met, we can focus on executing a long entry on this currency pair. The long entry would be initiated at the beginning of the candle immediately following the completion of the Morning Star pattern.

The third candle should be a long bullish candle, indicating a reversal of the downtrend.

More conservative traders could delay their entry and wait to see if price action moves higher. However, the drawback of this is that the trader could enter at a much worse level, especially in fast moving markets. We can see towards the bottom of this chart there was a Forex Morning Star pattern. And so, when the percent D line of the Stochastics indicator is in oversold territory, then that is usually a signal that prices are more likely to reverse to the upside. When you couple that oversold reading with a candlestick pattern like the Morning Star, that can provide for a high probability play to the long side.

A bullish reversal is signaled by the morning star candlestick, a triple candlestick pattern. It forms at the bottom of a downtrend and indicates that the downtrend is about to reverse. A candlestick chart with a long bearish candle, a short-lived bullish candle that gaps down from the first candle, and then a long bullish candle is what you want to find. Make sure the pattern is forming at the end of a downtrend or at the end of a consolidation period before trading it. An integral component of a technical trader’s toolkit is the morning star and evening star patterns. The forex market is known for its volatility, and it can be difficult for traders to predict market trends.

Four elements to consider for a morning star formation

It should be used in conjunction with other technical indicators and analysis to confirm the pattern and increase the chances of making a successful trade. The Morning Star and Evening Star are both reversal candlestick patterns found at the top or bottom of a price trend. However, morning stars can also occur amid a downtrend, making them difficult to interpret. For this reason, many traders believe that morning stars are only effective when they are accompanied by volume and another sign, such as a support level. Furthermore, staying informed about global economic events and news that can impact currency values is essential for successful forex trading. Factors such as interest rate decisions, geopolitical events, and economic indicators can significantly influence currency movements.

- Traders will often look for signs of indecision in the market where selling pressure subsides and leaves the market somewhat flat.

- TradingWolf and all affiliated parties are unknown or not registered as financial advisors.

- When entering into a long position using the Morning Star pattern, it can sometimes be difficult to gauge where the price target should be placed.

- That is to say that the exit signal would occur when the price closes back below this centerline of the Bollinger band.

- Morning Star pattern is relatively accurate, but traders are able to increase this accuracy by implementing other uptrend-detecting charts and indicators.

Candlestick charts are an invaluable tool that technical traders use to determine investor sentiment, which, in turn, can help them determine when to enter or exit trades. Candlesticks also tend to form repeatable patterns in any market and timeframe, which often forecasts a potential change in price direction. The morning star component of the pattern is derived from the candlestick pattern discovered near the bottom of a bearish trend and indicates the possibility of a trend reversal. Second, traders want to take a bullish position in the stock/commodity/pair/etc. Third, the formation of the morning star during the third session is considered to be proof that the pattern is correct (and a future upswing). Looking at the chart, once the formation has completed, traders can look to enter at the open of the very next candle.

The Top 5 Tools for Analyzing Forex Live Charts and Making Informed Trades

Otherwise, it is very easy to see morning stars forming whenever a small candle pops up in a downtrend. When trading the bullish Morning Star pattern, it’s best to focus on the highest probability set ups. One of the ways to do that is to take those trades wherein a bullish Morning Star pattern occurs at a key support level. When this occurs, it provides additional confirmation and confidence on the trade.

- The pattern consists of a long bearish candle, a short bullish candle that gaps down from the first candle, and then a long bullish candle that closes above the first candle’s midpoint.

- BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups.

- In terms of identifying a valid Morning Star pattern on the price chart, it’s important that the structure be analyzed in the context of the current price action.

- The evening star signals a reversal of an uptrend with the bulls giving way to the bears.

- Additionally, traders should consider using forex morning star patterns with other patterns to get their full benefits.

It has a bullish implication and can often pinpoint a major swing low in the market. In this article, we will take an in-depth look at this pattern, along with some of the best practices for trading it effectively. In morning star forex light of this, let’s examine the strategy for correctly identifying the morning star candlestick step by step. Note how the first red candlestick showed a slight increase in volume compared to the previous candle.

How to Use the Forex Morning Star Pattern to Make Profitable Trades

This prepares traders to enter long trade positions,

with the prices expected to increase soon. The morning star and evening star have a tad bit of difference, and the morning star has a flatter center candlestick, forming the Doji. There are no typical signs displaying anything, and it can show the pattern more clearly than a thick middle candlestick. When a Doji is formed with a black candle, the volume will go up in more significant frequencies, with the white candle becoming longer, indicating that the star is set to be forming.

Additionally, traders should consider setting profit targets to secure profits and avoid getting caught in market reversals. Both technical analysis and fundamental analysis are used by traders and investors in picking an investment as well as when to enter and exit the investment. Technical analysis uses historical data, mainly price and volume data to chart and predict an asset’s future movements. Another important factor is the volume that is contributing to the pattern formation. You can use the historic price action and analyze the structure and behaviour of the morning and evening star patterns on the Metatrader 5 trading platform, which you can access here. Relative Strength Index helps traders measure price fluctuation in

overbought and oversold market situations.

But if you think that this pattern will fit in your trading style, then you should absolutely use it. It is relatively easy to identify pattern, with relatively high accuracy and combines well with other patterns and indicators. The significance of this candlestick pattern is that, despite the bears temporarily winning the battle, the bulls were able to come back and eventually win. This can be seen by how the Doji has a long upper shadow, which shows that the bears tried to push prices lower but eventually failed. The small candlestick that gaps below the black candle should close within the body of the black one.